Shopfronts have shut and bills are rising, but consumers are still buying and the sector is recovering, totalling £39.4 billion in 2022. We dig into the latest industry statistics

The health and beauty sector can be difficult to understand because such a diverse range of services sit under this umbrella. It encompasses anything from skincare products and cosmetic procedures to health foods and fitness establishments – all of which have many brands and multiple variations.

Overall, the sector seems to be recovering from the drastic decline it experienced in 2021 and 2022, when the pandemic forced salons, clinics, gyms, and shops to shut their doors. Now, both the beauty and personal care market and the health and fitness market are expected to see positive annual growth rates of 1.71% and 12.75% respectively between 2023 and 2028* – although notably fitness is bounding ahead of beauty here.

However, the markets have not returned to business as usual. During the pandemic, consumer demands appear to have reconfigured, with customers moving towards home gyms as well as ethical and premium products. This means brands that are able to embrace innovation and dig down into these latest trends will likely be best placed to contend among what is a saturated and competitive space.

As a result, potential franchisees should be careful that they’re not blind sighted by the prospect of buying into an established and well-known brand based on reputation alone.

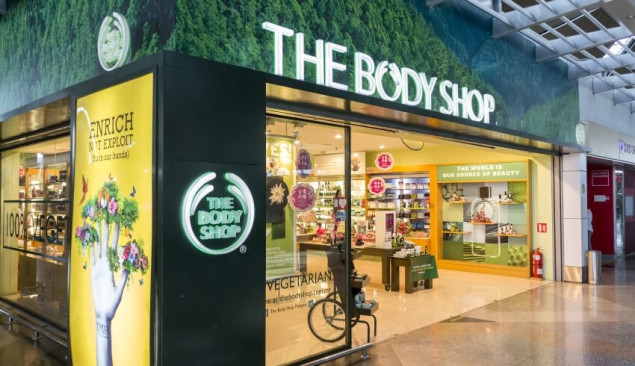

For example, The Body Shop – a brand that has been franchising for more than 40 years – has just been sold to Aurelius for a fifth of the £880 million price tag it had back in 2018. The business cited a 12% drop in sales, which is surprising considering its selling point is ethically sourced beauty products – but it’s speculated that lack of innovation has failed to captivate a new generation of consumers.

Skincare and cosmetics

Skincare certainly seems a viable route into the health and beauty market, and one that consumers began prioritising over cosmetics during the pandemic, when social contact was limited. For example, premium skincare brand Aesop grew by an average of 40% between 2020 and 2021 – a time when many consumers were beginning to become cash-strapped.

This behaviour has stuck and despite decreasing disposable incomes, consumers are moving towards paying premium prices for good quality products, especially those that avoid harmful chemicals and are devoid of animal testing – otherwise known as ‘clean beauty’ products.

We’re also seeing social media ‘skinfluencing’ consumers from a much younger age, which has broadened the market. One such trend has been South Korean products – so much so that shops such as PureSeoul, GlamTouch, and Nature Republic have popped up across the UK. However, in terms of franchising, this landscape remains largely untouched.

Willingness to embrace higher priced skincare echoes an increase in the consumption of non-surgical cosmetic procedures such as Botox, filler, and UV vitamin drips. These services can carry a big return on investment, but their success has been marred by conversations around their safety and threats of additional regulations around how and where these treatments can be administered.

Currently, regulation around procedures like Botox have been instated in reaction to its popularity. For example, in 2022, it became illegal to administer fillers and Botox to under-18s, after the Department of Health estimated around 70,000 minors were receiving the treatments each year. As of December 2023, there’s still no qualification standard for this type of cosmetic treatment.

It means that if you’re looking to invest in a franchise in this space, you must not only do your due diligence in terms of a brand’s training programme and reputation, but also anticipate future industry changes to which you will be required to adapt.

Hair and beauty salons

Traditional hair and beauty salons continue to be one of the most popular retail spaces on the high street, and although town centres have not weathered economic downturn well, those offering personal care services seem to have a level of buoyancy. In fact, during the first half of 2023, barber locations increased by 304 units, nail salons grew by 142 units, and beauty salons expanded by 130 units, according to a report by Local Data Company.

However, hairdressers have seen a significant decline, with 414 units disappearing from the sector in the same six-month time frame. The cull is largely believed to be a repercussion of the pandemic’s enforced closures combined with mounting energy costs, which are making it difficult to retain profit margins alongside price tags that consumers are willing to pay.

In 2022, The British Association of Beauty Therapy and Cosmetology (BABTAC) found 94% of its members had experienced a considerable increase in utility rates over the past 12 months, with 40% seeing their costs double, and 10% triple. More recently, a Uswitch survey found that energy bills alone accounted for 40% of the total costs for UK beauty, hair, and spa businesses.

It means that while demand is certainly there for beauty salons, it’s wise for potential investors to work out costing beyond those incurred from franchise agreements, especially if you’re intending to open a physical location. Regardless of the turbulence in the market, there is a legitimate opportunity here when it comes to consumer demand because people tend to pay for smaller niceties during difficult times – a term called ‘the lipstick effect’.

One opportunity that continues to rise in popularity, partly due to its lower overheads, is mobile and at-home services, which enable franchisees greater flexibility by avoiding reliance on having a shop. It does however mean either opening your home to clients, or travelling to clients, which comes with separate challenges.

There are currently franchises recruiting with more flexible models which enable investors to scale to the challenges of the market. For example, Mooeys offers three separate investment packages for franchisees, one of which is a mobile operation. The business has also diversified its offering by selling MOOSKIN skincare products – leaning into its cow-print aesthetic. The franchise’s approximate investment is £55,000, with 60% of this provided through funding.

Elsewhere, Headcase Barbers requires around £40,200 in minimum investment with third-party funding support. Tan & Deliver asks for between £30,000 and £100,000 depending on investment package, while Toni & Guy asks franchisees for a £96,000 minimum investment.

Essential health services

Private baby scanning businesses have faced growing demand for services, accompanied by industry criticism. In 2020, the British Medical Journal reported that 250 private ultrasound clinics had appeared on high streets in recent years. These brands enable mothers-to-be to have additional ultra-sounds on top of the ones they receive on the NHS, as well as take home keep-sakes from the experience – coining the service ‘souvenir scanning’.

While investing in this space could be fruitful, it’s worth investigating the industry criticism surrounding lack of qualified sonographers to understand where brands sit in this conversation. For example, Hey Baby 4D specialises in non-diagnostic pregnancy scans and screening tests which are carried out by qualified sonographers. The business estimates its minimum investment is £15,000+VAT with £250,000 in annual revenue by year two.

Meanwhile, Numi Scan does offer diagnostic scans such as vascular, general medical, and gynaecological with sonographers similarly registered with the Health & Care Professions Council. The brand estimates a minimum investment of £25,000 with an ROI and yearly revenue of £240,000 after two years.

While franchises that require qualified professionals, particularly in the medical space, may appear off-limits, they are often still accessible to willing investors. This is because franchisees can take on a management role while recruiting qualified staff to carry out the day-to-day services.

However, this does bring the challenge of recruitment into the fold, something that can be difficult when hiring incredibly specialised skills – although there is a rising trend of medical practitioners opting to work for private establishments over the NHS. In other cases, it may be that a franchise brand is looking exclusively for health professionals hoping to open a business.

Some areas of healthcare are particularly strong for franchise models. For example, in optometry and audiology franchising is commonplace, which could be a good area of investment if you’re looking to tap into a specialised field. Currently, Boots Opticians is recruiting franchisees with a start-up cost of £30,000, according to the BFA.

Gyms and health clubs

The number of gyms and fitness centres in the UK has been on an upward trajectory since 2011. However, that sharply decreased in 2021 when the pandemic put an end to many gym-goers being able to use their membership, causing locations to shut. Since then, we’ve began to see that number clamber up again, with research house Statistica forecasting 3720 gym locations open across the UK in 2022.

This growth has been evident across the franchise landscape, where multiple brands have conducted large-scale recruitment drives and expanded rapidly in the past 12 months. For example, Anytime Fitness, which has a minimum investment of £122,000- £187,000, opened four locations in its last quarter of 2023.

Players from outside the UK have also been eager to capture the market, with Australian brand Studio Pilates opening its first franchise branch in Exeter under the ownership of Felicity Kelly – a move that reportedly saw her earn £40,000 in the location’s first 30 days of trade. The business has since opened more branches in locations such as North London, Birmingham, and Leeds, and has an investment range of £250,000-£350,000.

However, despite the recovery of gym memberships across the UK, formulas that were tried and tested before the pandemic may not be indicative of success if brands aren’t able to adapt to market demand. There were significant behavioural changes in fitness consumers during the pandemic – as was also seen in the beauty sector. For example, in 2020, weight bench and stepper sales increased dramatically by 6500% and 4130%.

(Images: Shutterstock/mrfiza; Shutterstock/nimito; Shutterstock;PeopleImages-Yuri+A)

_59_59_80_s.jpg)

__59_59_80_s.jpg)